Recruitment Market Analysis — 2025

Quick summary (TL;DR)

2025 is a year of cautious growth and rapid transformation for recruitment. Global staffing is forecast to grow modestly (~4–6%), while hiring patterns shift toward skills-based, flexible work arrangements and heavy adoption of AI-enabled tools. Employers face tighter talent pools for specialized skills (AI/ML, cloud, healthcare), greater pressure on compensation, and the need to balance automation with humanized candidate experience. QXGlobalgroup –+1

- Market size & growth outlook

- Global staffing market: Forecasts for 2025 project low-to-mid single-digit growth versus 2024, with industry reports estimating the global staffing market in the hundreds of billions (estimates commonly cited around $600–$650B depending on methodology). Growth is driven by tech, healthcare, and flexible staffing demand. QXGlobalgroup –+1

- Regional variance: Mature markets (US, UK, Western Europe) show slower, more selective hiring and pockets of cooling in roles like entry-level or graduate hiring. Emerging markets and sector-specific pockets (IT services in APAC, healthcare in many countries) still show stronger demand. The Guardian+1

- Five key trends shaping 2025 recruitment

- AI everywhere — but balanced with humans. Nearly all large employers are using AI in sourcing, screening, and scheduling; most HR leaders stress that human oversight remains essential to avoid bias and preserve candidate experience. AI increases efficiency but introduces governance and fairness questions. Insight Global+1

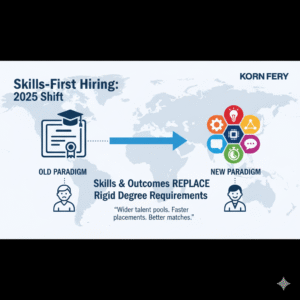

- Skills-first hiring replaces rigid degree requirements. Employers increasingly map roles to skills and outcomes rather than diplomas, speeding placements and widening candidate pools. Korn Ferry

- Hybrid / return-to-office dynamics reset hiring decisions. “Hybrid creep” — employers nudging employees back to more in-office days — is impacting candidate acceptance rates and talent sourcing strategies. Flexibility remains a competitive advantage for many hires. Business Insider+1

- Candidate experience and employer branding matter more than ever. Poor candidate journeys reduce hire conversion; companies investing in personalized communication, mobile-first apply flows, and coaching see better outcomes. Phenom

- Specialized talent scarcity fuels premium pay & alternative sourcing. Critical skills in AI, cybersecurity, cloud engineering, and healthcare command premium compensation and creative sourcing (gig / contractor models, nearshoring, apprenticeship programs). Recruiterflow+1

- Demand drivers & market forces

- Technology adoption (AI, automation) increases recruiter throughput and reduces time-to-fill for high-volume roles but also displaces some entry-level tasks. Insight Global+1

- Economic caution and inflationary pressures make companies more selective — hiring freezes and role prioritization occur in some sectors, even as other sectors expand. The Guardian

- Regulatory and compliance complexity (payroll, benefits, local employment law) is pushing more firms to outsource payroll and HR services to reduce operational risk and overhead. Staffing Industry Analysts

- Candidate behaviour & expectations

- Candidates increasingly evaluate offers on flexibility, growth path, and fairness (transparent pay and DEI). Remote/hybrid options still heavily influence acceptance decisions. The use of AI by applicants (to write resumes, prepare cover letters) is widespread and creates new vetting dynamics. Insight Global+1

- Technology & operations impact

- Recruitment tech stack in 2025: ATS + AI screening + skills assessment platforms + video interviewing + analytics dashboards. Investment priorities: bias-mitigation tools, candidate experience improvements, and integration with total talent management. Deloitte+1

- Implication for recruiters: Upskill in AI oversight, data literacy, and consultative hiring (skills mapping, workforce planning).

- Risks & challenges

- Bias & compliance risk from AI — poor model governance can create legal and reputational exposures. Deloitte

- Candidate supply-demand mismatch in critical skill areas causing longer fill times and higher offers. Business Insider

- Economic sensitivity — hiring demand may retract quickly in certain sectors if macro conditions weaken.

- Opportunities for recruitment firms & HR service providers

- Offer managed/3rd-party payroll + compliance bundles to clients who want to reduce administrative burden and legal risk. (This is a prime upsell given regulatory complexity.) Staffing Industry Analysts

- Build skills-assessment and reskilling partnerships with training providers to supply entry pipelines for clients shifting to skills-first hiring. Korn Ferry

- Provide AI governance audits and candidate-experience re-design services — high demand as clients adopt AI but seek safe, fair implementations. Insight Global+1

- Recommendations — what to highlight on your website

- Lead with outcomes: Time-to-fill, compliance uptime, cost-savings examples (case snippets).

- Show your AI & ethics stance: Describe how you use AI, what safeguards you apply, and emphasize human oversight. Insight Global

- Offer flexible engagement models: Contract, temporary-to-perm, RPO, managed payroll — explain when each is best. Staffing Industry Analysts

- Highlight candidate experience: Mobile apply, transparent pay ranges, and counselor/FAQ support. Phenom

- Localize content: Include region-specific compliance and benefits expertise (e.g., India PF/ESIC, EU statutory rules) for credibility. Staffing Industry Analysts

- Suggested website layout (brief)

- Hero: 1-line value prop (e.g., “Hire faster. Stay compliant. Delight candidates.”)

- Metrics strip: Time-to-fill, clients served, compliance incidents avoided.

- Services tiles: Recruitment, RPO, 3rd-party payroll, compliance, AI-audits.

- Case studies / testimonials (industry + measurable outcomes).

- Resources: 2025 hiring trends brief, AI governance checklist, salary benchmarks.

- CTA: “Schedule a 15-minute compliance & cost-savings review” (link to calendar).

Sources & further reading (selected)

- Korn Ferry — Talent Acquisition Trends 2025. Korn Ferry

- Staffing Industry (global market estimates & forecasts). Staffing Industry Analysts

- Insight Global — 2025 AI in Hiring Report. Insight Global

- Deloitte — AI in Talent Acquisition (2025 insights). Deloitte

- LinkedIn / Phenom / Robert Half reports on recruiting & remote work trends. LinkedIn Business Solutions+2Phenom+2